When people think about dog bite cases in California, they often focus on liability—who is legally responsible for the injury. That makes sense. After all, liability determines whether the dog owner can be held accountable at all.

But in real-world dog bite litigation, the most important and most aggressively contested battle often happens somewhere else entirely: insurance coverage.

At WIN Injury & Accident Trial Lawyers, we routinely handle dog bite cases where liability is clear and undisputed, yet the insurance company still refuses to pay fair compensation. Why? Because insurers frequently rely on breed exclusions or restrictive policy language buried deep within homeowners’ or renters’ insurance policies. These exclusions are often unknown to the dog owner—and completely unexpected by the injured victim—until after a serious injury occurs.

Understanding how insurance coverage works in dog bite cases, and how insurers use breed exclusions to deny or limit claims, can be the difference between a minimal recovery and full financial compensation for medical bills, lost income, scarring, and long-term trauma.

Dog Breed and Liability Under California Law

California law strongly favors dog bite victims when it comes to liability.

California is a strict liability state for dog bites. Under California Civil Code § 3342, a dog owner is generally responsible for injuries caused by their dog, regardless of:

- The dog’s breed

- Whether the dog had ever bitten anyone before

- Whether the owner knew the dog was dangerous

In other words, the law does not give dog owners a “free pass” simply because their dog had no prior history of aggression.

This means:

- The victim does not have to prove the dog was vicious or dangerous

- The victim does not have to prove the owner was negligent

- The dog’s breed does not affect whether the owner is legally responsible

As long as the victim was lawfully present and did not provoke the dog, liability is typically straightforward.

Where Breed Really Matters: Insurance Coverage

Most dog bite claims are paid through homeowners’ or renters’ insurance, not directly out of a dog Where Breed Really Matters: Insurance Coverage

While California law makes dog owners strictly liable for bite injuries, insurance coverage is where dog breed suddenly becomes critically important.

In most dog bite cases, compensation does not come directly from the dog owner’s personal bank account. Instead, claims are typically paid through a homeowners’ or renters’ insurance policy. These policies are designed to cover personal injury claims arising from everyday risks—including dog bites.

However, this is also where insurance companies often attempt to escape responsibility.

Breed-Based Exclusions Are Common—and Often Hidden

Many insurance policies contain breed-based exclusions or restrictions that limit or eliminate coverage for injuries caused by certain dogs. These exclusions are frequently buried deep within policy language, endorsements, or underwriting guidelines that policyholders rarely read or fully understand.

As a result, many dog owners are unaware that their insurance coverage may be severely limited—or nonexistent—until after a serious injury occurs.

While exclusions vary by insurer and policy, commonly targeted breeds often include (but are not limited to):

- Pit bull–type dogs

- Rottweilers

- German Shepherds

- Dobermans

- Akitas

- Chow Chows

Some insurers also attempt to exclude dogs they label as “mixed breed” if they believe the dog has characteristics of a restricted breed, even without genetic proof.

Different Types of Breed Restrictions Insurers Use

Not all breed restrictions operate the same way. Insurance companies use several strategies to limit exposure in dog bite cases:

1. Outright Coverage Exclusions

Some policies completely exclude coverage for injuries caused by certain breeds. If the insurer applies this exclusion, it may refuse to pay any damages at all, regardless of how severe the injury is or how clear liability may be.

2. Refusal to Defend the Dog Owner

Even when coverage is disputed, insurers typically have a duty to defend their insured. In breed exclusion cases, insurers may attempt to avoid even providing a legal defense—leaving the dog owner personally responsible for attorney’s fees and litigation costs.

3. Conditional or Limited Coverage

Other policies impose special conditions, such as:

- Higher premiums for certain breeds

- Lower policy limits for dog bite claims

- Requirements for training, muzzling, or fencing

- Exclusions triggered by alleged policy violations

Insurers may argue that failure to meet any condition voids coverage entirely.

4. Post-Injury Policy Rescission or Cancellation

In some cases, insurers attempt to cancel or rescind coverage after a bite occurs, claiming the dog’s breed was misrepresented when the policy was issued. These post-loss tactics are frequently contested and may be unlawful.

Why Insurers Rely So Heavily on Breed Exclusions

Dog bite claims are among the most expensive personal injury claims insurers face—especially when injuries involve children, facial scarring, nerve damage, infections, or permanent disability.

From an insurer’s perspective:

- Breed exclusions reduce financial exposure

- Coverage denials discourage claims

- Policy ambiguity creates leverage against unrepresented victims

As a result, insurance companies often aggressively assert breed exclusions, even when the evidence is weak, the policy language is unclear, or the exclusion may not legally apply.

Why These Disputes Are Common in Southern California

Breed-based coverage disputes are especially common in:

- Los Angeles County

- Orange County

- Riverside County

- San Bernardino County

In these areas, renters’ insurance policies are widespread and often cost-driven, meaning exclusions and limitations are more aggressive. Many dog owners are unaware their policy excludes coverage until after a serious injury occurs.

What Dog Dog Bite Insurance Litigation Often Involves

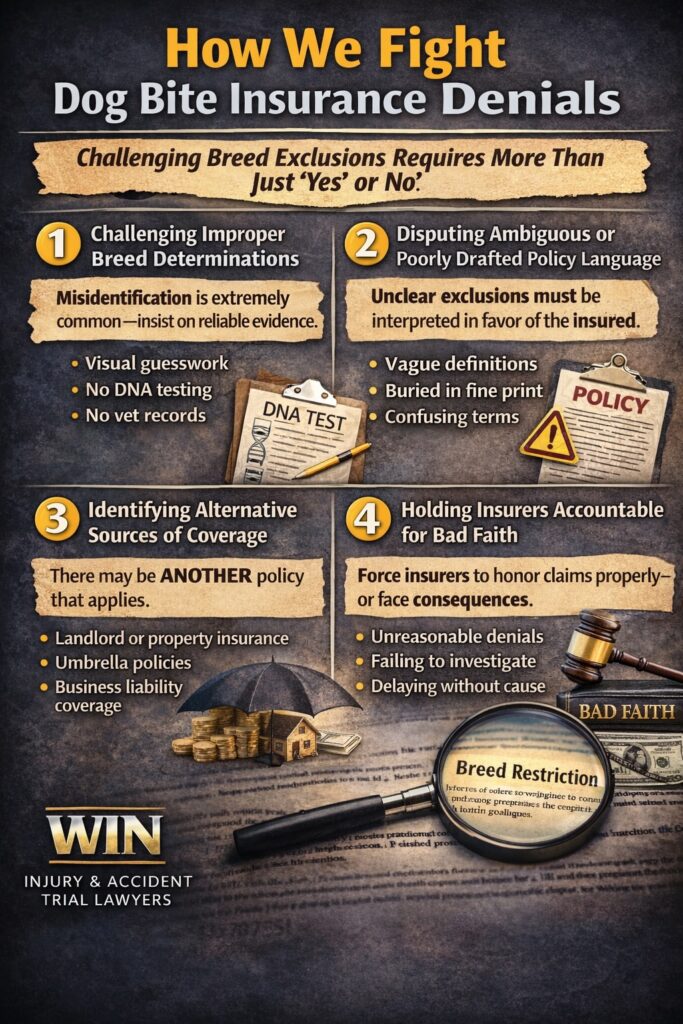

Challenging a breed exclusion is not a simple yes-or-no issue. Insurance companies often present coverage denials as final and unquestionable—but in reality, many of these denials rest on assumptions, weak evidence, or legally flawed interpretations of the policy.

As a result, dog bite cases involving breed exclusions frequently evolve into complex insurance litigation, requiring careful factual investigation, policy analysis, and, when necessary, aggressive legal action. Common areas of dispute include the following:

1. Challenging Improper Breed Determinations

Insurance companies often label a dog as a “restricted” or “excluded” breed without reliable proof. In many cases, the insurer’s determination is based on:

- A claims adjuster’s visual assessment

- An animal control description

- Shelter paperwork using vague breed labels

- Statements from third parties with no expertise

Critically, insurers frequently make these determinations without veterinary records, DNA testing, or expert analysis.

Misclassification is especially common with:

- Mixed-breed dogs

- Rescue dogs

- Dogs with no formal breed documentation

Insurers may argue that a dog “appears to be” a restricted breed—or has certain physical traits—despite lacking any scientific or factual basis. These determinations are often challengeable, particularly when the policy language does not clearly define how breed is to be established.

2. Disputing Ambiguous or Poorly Drafted Policy Language

Under California law, insurance exclusions must be clear, explicit, and narrowly construed. Any ambiguity is generally interpreted in favor of coverage, not the insurance company.

Many breed exclusions fail this test.

Common problems include:

- Undefined terms like “pit bull–type dog”

- Broad or vague references to “aggressive breeds”

- Inconsistent definitions across policy sections

- Exclusions buried in endorsements not clearly disclosed

When policy language is unclear or internally inconsistent, insurers may not be entitled to rely on the exclusion at all. Courts often scrutinize whether the average policyholder could reasonably understand the scope of the exclusion at the time the policy was issued.

In these cases, coverage disputes turn on contract interpretation, not the dog’s behavior or the severity of the injury.

3. Identifying Alternative Sources of Insurance Coverage

Even when one insurer denies coverage, that does not mean compensation is unavailable.

An experienced dog bite attorney will look beyond the initial denial to identify all potential sources of coverage, which may include:

- Landlord or property owner insurance, particularly in rental properties

- Additional insured or secondary policies connected to the premises

- Umbrella or excess liability policies with higher limits

- Business or premises liability coverage, if the bite occurred in a commercial or work-related setting

In many cases, insurers deny coverage hoping victims will stop investigating. A thorough coverage analysis often reveals policies that apply—even when insurers claim otherwise.

4. Holding Insurers Accountable for Bad Faith Conduct

Insurance companies have a legal duty to fairly investigate, evaluate, and handle claims. When an insurer:

- Denies coverage without a reasonable investigation

- Relies on unsupported assumptions about breed

- Ignores evidence contradicting a denial

- Delays payment without justification

…it may be exposed to insurance bad-faith liability.

Bad-faith claims can dramatically change the value of a case. In addition to policy benefits, insurers may be responsible for additional damages, including interest, attorneys’ fees, and in some cases punitive damages.

Importantly, bad-faith exposure often creates powerful leverage—forcing insurers to reconsider denials they initially insisted were non-negotiable.

Why This Matters

From the outside, a dog bite case may appear straightforward. But when insurance companies invoke breed exclusions, the case often becomes a high-stakes insurance dispute that requires both personal injury and coverage litigation expertise.

Successfully navigating these issues can:

Transform a denied claim into a substantial recovery

Unlock policy limits insurers claim do not exist

Reveal coverage hidden behind denials

Why Legal Representation Matters in Breed Exclusion Cases

Insurance companies are highly motivated to avoid large dog bite payouts. They often contest coverage aggressively, even when liability is clear.

An experienced dog bite attorney can:

- Analyze the policy for hidden weaknesses

- Push back against improper exclusions

- Force insurers to honor their obligations

- Maximize recovery through litigation when necessary

In many cases, the insurance fight becomes just as important as the underlying injury claim.

The Bottom Line

Dog breed does not determine legal responsibility in California—but it often determines whether insurance will pay.

If you or your child were bitten by a dog and the insurance company is citing a breed exclusion, do not assume the denial is valid. These exclusions are frequently challenged—and often overcome—with the right legal strategy.

Speak With a California Dog Bite Attorney

At WIN Injury & Accident Trial Lawyers, we handle complex dog bite cases involving insurance denials, breed exclusions, and bad-faith conduct. We know how to confront insurers and fight for the compensation our clients deserve.

Get Help From WIN Injury & Accident Trial Lawyers

Why Legal Representation Matters

Insurance companies often undervalue pain and suffering—offering minimal settlements that ignore your daily struggles. A skilled attorney can:

- Present powerful evidence of your emotional and physical suffering

- Retain expert witnesses to quantify your losses

- Use verdict data to justify higher multipliers or per diem rates

- Argue your case persuasively before a jury

At WIN Trial Lawyers, our team fights to ensure that your recovery reflects the full extent of your suffering—not just your bills.

At WIN Trial Lawyers, we know how personal injury claims can be can be. Victims often face mounting medical bills, lost wages, and emotional trauma. Our team has successfully taken on insurance companies and third parties, recovering millions for injured clients.

If you or a loved one has been injured in an accident, don’t leave your future in the hands of the insurance company. You need experienced trial lawyers who know how to prove liability and fight for maximum compensation.

If you or a loved one has been injured, don’t face this alone. The sooner you act, the stronger your case will be.

🔗 Related Posts:

Frequently Asked Questions About Dog Bite Insurance & Breed Exclusions

Does a dog’s breed affect liability in California dog bite cases?

No. California is a strict liability state under Civil Code § 3342. A dog owner is generally responsible for a bite regardless of the dog’s breed, size, or prior behavior.

Why do insurance companies deny dog bite claims based on breed?

Insurance companies often rely on breed-based exclusions in homeowners’ or renters’ insurance policies to limit or deny coverage. These exclusions are a coverage issue—not a liability issue—and are frequently buried in policy language.

Are breed exclusions in insurance policies always enforceable?

No. Breed exclusions must be clear, specific, and properly applied. Ambiguous or poorly drafted exclusions may be unenforceable under California law and can often be challenged.

What if the dog is a mixed breed?

Insurers frequently attempt to deny coverage by claiming a mixed-breed dog has characteristics of an excluded breed—even without DNA testing or veterinary proof. These determinations are commonly disputed and may not hold up legally.

Can an insurance company deny coverage without investigating the dog’s breed?

No. Insurers have a duty to conduct a reasonable investigation before denying a claim. Denials based on assumptions or visual guesswork may expose the insurer to bad-faith liability.

What happens if the dog owner has no insurance coverage?

Even if one policy denies coverage, other sources may still apply, including:

- Landlord or property owner insurance

- Umbrella or excess liability policies

- Additional insured policies

- Business or premises liability coverage

An experienced attorney can identify coverage insurers fail to disclose.

Can an insurance company be sued for denying a dog bite claim?

Yes. If an insurer unreasonably denies coverage, delays payment, or fails to investigate properly, it may be liable for insurance bad faith, which can significantly increase the value of the case.

Do I need a lawyer if the insurance company says there’s no coverage?

Absolutely. Coverage denials are often not final. A dog bite attorney experienced in insurance litigation can challenge exclusions, force proper investigation, and uncover alternative coverage.

How long do I have to file a dog bite claim in California?

In most cases, the statute of limitations for personal injury claims—including dog bites—is two years from the date of injury. Insurance coverage issues should be addressed as early as possible.

What if the insurance policy never mentioned a breed exclusion?

If the policy did not clearly disclose a breed exclusion at the time it was issued, the insurer may not be allowed to rely on it later. Hidden exclusions, undisclosed endorsements, or vague references can be challenged under California insurance law.

Can an insurance company cancel coverage after a dog bite occurs?

Insurers sometimes attempt to cancel or rescind a policy after a dog bite, claiming the dog’s breed was misrepresented. Post-loss cancellations are heavily scrutinized and may be unlawful, especially if the insurer accepted premiums without proper investigation.

Does renters’ insurance cover dog bites?

In many cases, yes—but renters’ policies are also more likely to contain breed exclusions or low policy limits. Each policy must be analyzed individually to determine whether coverage applies.

What if the dog bite happened at an apartment complex or rental property?

If the bite occurred on rental property, the landlord or property owner’s insurance may provide coverage—particularly if the owner knew about the dog, allowed it on the premises, or failed to enforce pet restrictions.

Are landlords responsible for dog bites in California?

Landlords may be liable if they knew or should have known a dog posed a danger and had the ability to remove it or require safety measures. This can create additional insurance coverage beyond the dog owner’s policy.

What if the bite happened at a business or workplace?

Dog bites occurring in workplaces, stores, offices, or commercial properties may trigger business or premises liability insurance, even if the dog belongs to an employee or third party.

Can an insurer deny coverage because the dog had bitten someone before?

Prior bite history does not automatically eliminate coverage. While insurers may attempt to rely on exclusions or policy conditions, each denial must still comply with California law and the specific policy language.

Does a “one-bite rule” apply in California?

No. California does not follow a one-bite rule. Dog owners are strictly liable for bites regardless of prior incidents, and insurers cannot deny liability coverage based solely on a first bite or lack of prior bites.

What damages are typically available in dog bite cases?

Dog bite victims may recover compensation for:

- Emergency and ongoing medical treatment

- Plastic or reconstructive surgery

- Scarring and disfigurement

- Lost wages and reduced earning capacity

- Pain, suffering, and emotional trauma

Insurance coverage disputes often determine how much of this compensation is actually recoverable.

Why do insurance companies fight dog bite claims so aggressively?

Dog bite claims are among the most expensive personal injury claims, especially those involving children or facial injuries. Insurers often view breed exclusions as a cost-control tool and litigate these cases aggressively.

Should I give a recorded statement to the insurance company?

You should not provide a recorded statement without speaking to an attorney. Insurers may use statements to support breed exclusions, misclassification, or denial theories.

How long does it take to resolve a dog bite insurance dispute?

Simple claims may resolve in months, but cases involving coverage denials, multiple policies, or bad-faith claims can take longer. The upside is that challenging coverage can significantly increase recovery.

What makes WIN Injury & Accident Trial Lawyers different in dog bite cases?

WIN combines personal injury litigation with insurance coverage and bad-faith experience, allowing us to:

- Challenge improper breed exclusions

- Identify hidden or secondary coverage

- Force insurers to honor their obligations

- Maximize compensation when denials occur